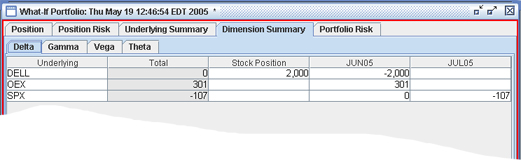

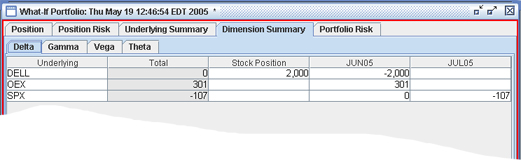

Portfolio Analytics - Dimension Summary

Each Greek value represents a different dimension of risk. The Dimension Summary page tabulates the total risk by underlying and expiry for each of these risk dimensions.

|

Dimension Summary Tab |

|

|

Risk Dimension |

Description |

|

Delta |

Delta represents the change in an option price relative to a change in the price of the underlying. Each cell in the expiry column(s) represents the sum of all Delta risk positions for the given underlying and expiry. |

|

Gamma |

Gamma represents the rate of change of Delta. Each cell in the expiry column(s) represents the sum of all Gamma risk positions for the given underlying and expiry. |

|

Vega |

Vega represents the change in an option price relative to a change in volatility. Each cell in the expiry column(s) represents the sum of all Vega risk positions for the given underlying and expiry. |

|

Theta |

Theta represents the time-value decay. Each cell in the expiry column(s) represents the sum of all Theta risk positions for the given underlying and expiry. |

A Portfolio Value plot can be seen at the bottom left of the window. It shows the change in portfolio market value over a range of underlying price changes.